The Tax Amnesty Scheme 2018 was announced by the former Prime Minister Shahid Khaqan Abbasi on 5th April 2018. The amnesty scheme and the following budget are comprehensive efforts by the state and former government to formalize the economy and, more urgently, shore up Pakistan’s foreign currency reserves.

The situation was slightly ambiguous previously. The Supreme Court had yet to give a ruling on the scheme, so a lot of people were cautiously holding back to see how the situation unfolds. Now that the Supreme Court has given the green signal to the amnesty scheme, people have begun availing it in large numbers and the scheme seems geared for success.

There’s still a week to go before the period of Tax Amnesty 2018 ends on June 30, 2018. There have been calls for extension of the amnesty scheme period, but whether or not that happens, there is still ample time for you to avail the scheme. This is what the blog is about. It takes you through the entire process of registering for and availing the Tax Amnesty Scheme 2018.

1. Register on FBR Iris system.

There are two ways you can do this: you can register exclusively for the amnesty scheme, as shown below, or you can register normally on Iris. It is recommended to simply do the latter since you cannot file your taxes if you register only for amnesty scheme. To do that, you can check our post on how to register online to file your income tax returns as it takes you through the entire process of registration on Iris.

Note that if you are already registered on Iris, you don’t need to register again. If you are looking to simply register for the Tax Amnesty Scheme 2018, you can follow the steps below. The process is almost the same as normal registration:

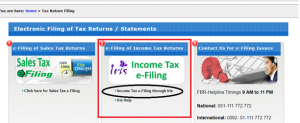

i. Visit FBR website and click “File Returns”, as shown in the image below.

ii. From there, you can go to Iris:

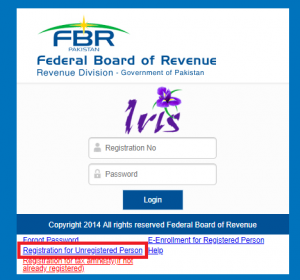

iii. Next, you will have to click “Registration for tax amnesty(if not already registered)”, as outlined in the image below:

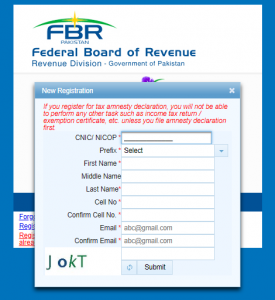

iv. This will open a dialog box that you will have to fill:

v. Once you fill out the details, and click “Submit,” you will receive a text containing your login details, on both your email and mobile phone (if the number is Pakistani). You will be able to use those to log into the Iris system.

2. Calculate your taxes

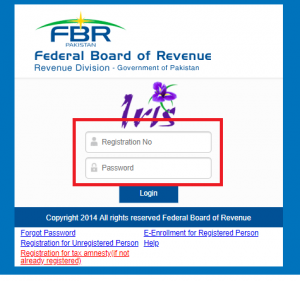

Once you have registered, you will be able to log into Iris, as outlined in the image below:

Calculating taxes on foreign assets:

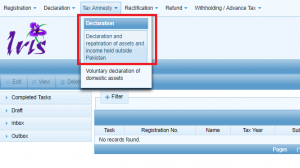

i. When you log in, you will directed to the page as shown below. If you are looking to declare your foreign assets, you will need to click the “Declaration and repatriation of assets and income held outside Pakistan” as encircled below:

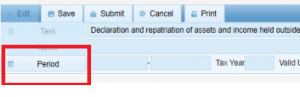

ii. You will be directed to the page, as shown below. Once there, you will have to add the tax “Period” first, as outlined:

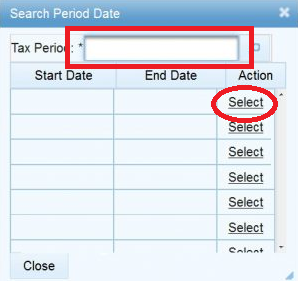

iii. The following dialog box will open. You will have to input “2018” in the “Tax Period” and click the search icon. “Select” the relevant period, as shown in image below:

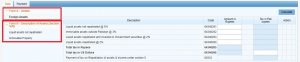

iv. As a result, you will be directed to the page shown below, where you can input the details of the foreign assets that you want to declare. Clicking on “Foreign Assets”, “Liquid assets not repatriated” and “Immovable Property” will open screens where you can input the details of your property. You just have to input amounts in the field where editing is enabled. In places where you may have to input additional details about the amounts, you will see the “+” sign and you can click it to add the details.

Once you have added all the details, you will need to “Calculate”.

v. You will find out the amount you have to pay in taxes on these foreign assets.

Calculating taxes on domestic assets

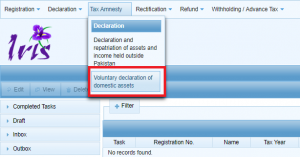

i. The process for this is not much different. You will have to select “Voluntary declaration of domestic assets”, as shown in the image below:

ii. You will have to select period, as explained in points ii and iii of the previous section on foreign assets.

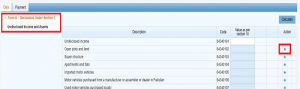

iii. Once the period has been added, you will be directed to the page shown below. There you can add details of your domestic assets, and where needed, you can add further details about your property by clicking the “+” sign.

iv. When you “Calculate”, you will be able to find the amounts you need to pay under the domestic assets as well.

3. PSID generation

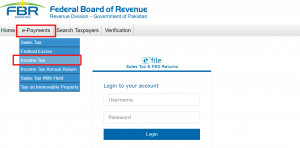

i. To make payments under either of the above options, you will have to visit the FBR portal . That’s where you will be able to generate Payment Slip ID (PSID).

ii. Click on “e-Payments” and then click “Income Tax” tab within it, as outlined in the image below.

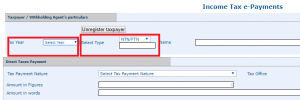

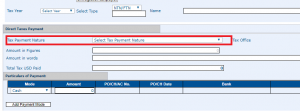

iii. You will be taken to the following page, where you will select the “Tax Year” (2018) and change the “Select Type” (outlined in the image) to “CNIC”. Finally, you will have to write your CNIC number in the section right below it, with dashes. The system will fill out the remaining details for you.

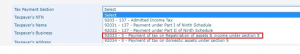

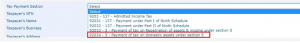

iv. In the “Direct Taxes Payment” section below, you will have to “Select Tax Payment Nature”. For amnesty scheme, choose “Admitted Income Tax.”

v. To pay taxes on foreign assets, further select “92033-5- Payment of tax on Repatriation of assets & income under Section 5”.

vi. For taxes on declared domestic assets, select “92034-5- Payment of tax on domestic assets under Section 5”.

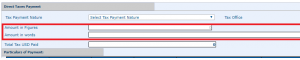

vii. Add amount.

viii, Add payment method, enter the amount in the proper section again, enter your mobile number and email, and click “Create”.

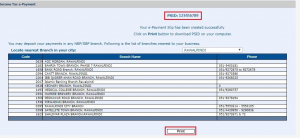

ix. You will be directed to the following screen. There, you can note down the PSID number or print out the PSID.

4. Payment under Tax Amnesty 2018

Foreign Assets

i. Finally, on the payment part, to pay taxes on the foreign assets, you will have to remit the taxes due, in USD, to the following SBP account:

Name of Payee: State Bank of Pakistan

Payee’s Address: I.I. Chundrigar Road, Karachi, Pakistan

Payee’s SWIFT Code: SBPPPKKA

Bank Name: National Bank of Pakistan

Bank Address: New York, USA.

Payee’s Account Number: 55854560

Bank SWIFT Code: NBPAUS33

When you have paid the taxes to the SBP account, you will have to email the copy of wire transfer and other details, including your CNIC/NTN number and signed copies of your PSID to SBP email address: tax.foreignasset@sbp.org.pk

SBP will send you back the scanned copy of Computerised Payment Receipt (CPR).

ii. To repatriate liquid foreign assets so they could be credited into your PKR account and/or invested into Federal Government bonds, you will have to remit your liquid assets to the account mentioned above. You will also have to email the same details as above. Other things you will have to send will include:

a. An application with signed statement to have the liquid assets invested in Government bonds and the amount to be credited to PKR account of tax payer.

b. A copy of your CNIC

c. Complete details of your PKR bank account where you will be credited with the liquid assets and be sent the profits on your investment. These include bank and branch name, account title, and IBAN of your PKR bank account.

d. You will receive confirmation from SBP that your assets have been invested.

Domestic Assets

i. For payment of taxes on domestic assets, you can make the payment online through your bank account, billing it to the FBR, using your PSID Number.

ii. Or you can visit an ATM and follow the same procedure as paying a bill to the FBR, again with the help of your PSID number. These are new services launched by FBR to facilitate payment of taxes for the taxpayers.

iii. A Computerised Payment Receipt (CPR) will be sent to your email, and you will also receive a confirmation SMS. CPR will also be available on your Iris account for any future use.

iv. An alternative is to visit your nearest State Bank of Pakistan (SBP) or National Bank of Pakistan (NBP) with your CNIC and the printout of PSID. Consequently, you will get a stamped copy of your CPR from the cashier at the bank.

5. Submission of Amnesty Declaration Form

i. This is the final step in the process. You will have to log into FBR Iris, and then on the screen that appears, click “Draft”, as indicated below:

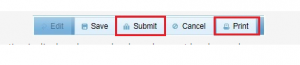

ii. Consequently, you will see two drafts in the tax section (if you are availing both domestic and foreign assets side of the scheme). When you click either of them, you will be able to “Edit” them, by pressing the tab indicated in the image above.

iii. You will be led to the following screens, depending on whether it is a foreign or domestic asset.

In case of domestic assets

In case of foreign assets

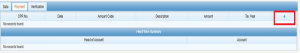

iv. In both cases, you will have to click “Payment” tab. This will lead you to the following page, where, you will need to click the “+” button on the extreme right, as indicated in the image below.

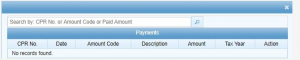

v. You will be led to the following screen, where you can add your CPR number and search for it:

vi. When the CPR has been added, you will to click the “Verification” tab as indicated below:

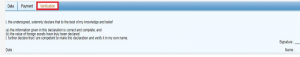

vii. You will have to read the declaration and enter your PIN (sent to you when you make IRIS account) and then, finally, click “Submit”, as shown in the image below:

viii. Once you submit declaration, it cannot be changed and will become read-only.

ix. You can print that declaration by clicking the “Print” button shared above.

That’s it, folks! If you have followed all the steps from the top, you assets have been legalized. If you have any questions about, you can ask away in the comments section below.

Get professional back glass replacement services in Winnipeg. We ensure safe installation, durability, and clear visibility for all vehicle types.

ReplyDelete